New Funding Opportunity!

Use Your Pennsylvania Tax Dollars to Support Melmark!

The Pennsylvania Educational Improvement Tax Credit (EITC) program is a Department of Community and Economic Development program that allows donors to re-direct their Pennsylvania state tax dollars to approved Educational Improvement Organizations (EIO), of which Melmark is one.

The Friends of Education, a state-approved special purpose entity through which individuals may participate in the EITC program, has tax credits available. We are reaching out to the Melmark community to make them aware of this opportunity to support Melmark and receive up to 90% in tax credits for that support; tax credits are limited and offered on a first-come, first-served basis.

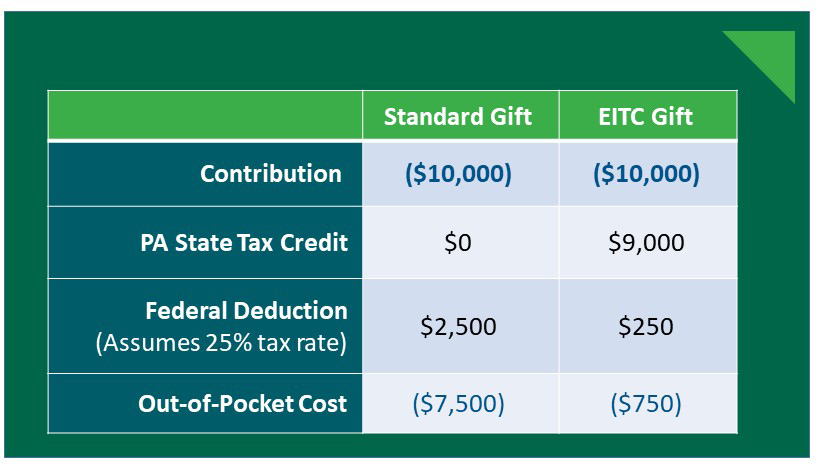

Here is an example of how a $10,000 contribution could, with tax credits, cost a donor as little as $750.

► Click here to view the pdf newsletter for further information.

For more information, you may contact the Friends of Education directly at:

Todd S. Unger, Esq., todd.unger@pataxcredits.org

Jed Silversmith, Esq., jed.silversmith@pataxcredits.org

You may also contact Melmark’s Director of Advancement, Lisa Ketcham, at lketcham@melmark.org.

Thank you for considering this new source of funding for Melmark,

Mission First. Every Individual, Every Day.

Any information provided by Melmark or its representatives is not official financial or tax advice.

Please consult your own tax advisor regarding participation.